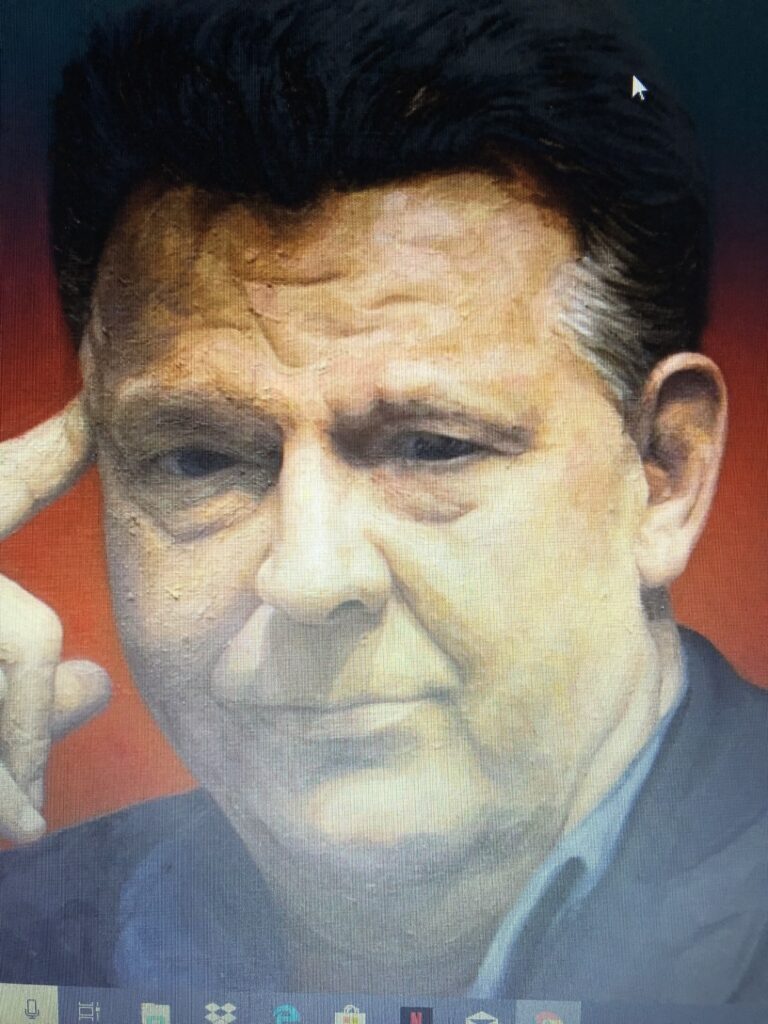

Anatomy of Traian Cabba’s Alleged Investment Scams

Beware the Snake Oil Salesman

To the casual onlooker, Traian Cabba has it all – bespoke Italian suits, constantly circling the globe, mansions scattered across glitzy destinations.

He glides through exclusive events reeling in new moneyed contacts with ease.

But according to ex-wife Francesca Patti, his lavish lifestyle stems from increasingly brazen fraud carried out through a complex corporate labyrinth. Multiple sources claim Cabba fleeces investors to fund this high life.

He first landed on Unrecommend’s radar due to a court battle with his ex-wife, Francesca Patti, who has a court judgement in her favor for $599,391 which he has evaded for years with impunity.

According to his ex-wife, “Cabba shifts assets between dozens of companies to hide anything of value.” Corporate filings trace back to a conglomerate called Trimar Group. “It’s a complex financial hall of mirrors,” Patti notes.

“Traian will promise you anything – partnerships, wealth, the inside track on hot deals,” Patti revealed in an exclusive tell-all interview. “But behind the charm spins a ruthlessly cunning con man.”

The High Rolling Front

Cabba presides over a sprawling empire including key entities such as Canadian Petrus Oil and Gas Inc, Trimar Group of Companies Inc, Trimar Real Estate, Polyval Worldwide, Trimar Group, and Amphion Group Inc.

According to Patti, “Traian shields all assets and money within corporate names to prevent debtor claims.“

By maintaining negligible personal holdings, Cabba structures affairs to prevent individuals suing him. Sources allege he secures lending then transfers funds to his controlled corporations.

“Traian borrowed massively in my name while holding all real estate and other valuables in his companies,” Patti charges. “He manipulates legal systems using false documents to hide anything of value.“

Traian Cabba's Web of Deceit

In the intricate tapestry of global finance, few threads are as enigmatic and tangled as those woven by the hand of Cabba. At the heart of this labyrinth lies a constellation of corporate entities: Canadian Petrus Oil and Gas, Trimar Group of Companies Inc, Trimar Real Estate, Polyval Worldwide, Trimat Group, Amphion Group Inc. According to insider testimonies, this sprawling empire serves as the vessel for Cabba’s sophisticated maneuvers, securing loans only to siphon the proceeds into the vaults of his own corporations, thereby placing them out of the grasp of any potential legal reckoning.

Yet, beneath this veneer of corporate machinations lies a darker, more deceptive stratagem. A $370 million judgment from Saudi Arabia, brandished by Cabba with a cavalier pride, is alleged to be nothing more than a façade, a cunning ploy designed to obfuscate the murky rivers of capital that meander through his empire.

Cabba's Exploitation of International Legal Ambiguities

The breadth of Cabba’s operations reveals a masterful exploitation of international legal ambiguities, stretching from the frosty climes of Canada to the sunlit shores of Panama, and onto the storied island of Cyprus.

What emerges from the depths of this investigation is a portrait of an international money laundering syndicate, its audacity and scope enough to leave even the underworld’s most hardened veterans in shades of envy.

Patti, shedding light on the intricacies of this operation, contends that the aforementioned Saudi judgment flaunted by Cabba is but a veil, cleverly crafted to conceal transactions far more insidious and intertwined with the global web of financial malfeasance.

By navigating through a maze of legal loopholes across continents, Cabba has allegedly orchestrated an operation of money laundering whose magnitude is without precedent, casting long shadows over the international financial system.

The Triangle of Corruption

The shadowy saga of Cabba’s financial empire cannot be attributed to the machinations of a solitary figure. Our investigative journey has peeled back the layers on a nefarious triangle of collaborators and facilitators, who have been instrumental in perpetuating Cabba’s suspected financial wrongdoings.

At the vortex of this intricate network stands Sonia Bustillo, entwined with Cabba not only through the bonds of alleged long-term romance and partnership in business but also as the mother of his child. Bustillo is accused of operating a complex financial network, with bank accounts scattered across Canada and the globe, purportedly holding funds on Cabba’s behalf. Their relationship, cemented by the birth of their son, Jesse Jayden, amidst the tenure of Cabba’s marriage to Patti, takes a darker turn with allegations that Jesse Jayden’s identity is now leveraged for banking transactions, effectively replacing Patti’s son in the financial schema.

Angela Lopresti, a cousin of Bustillo, emerges as the second nexus in this elaborate scheme of money laundering. Lopresti, despite an apparent lack of formal employment, is alleged to manage a portfolio of bank accounts in the UK and Europe, serving as financial shields for Cabba against the prying eyes of legal authorities. Reports suggest Lopresti enjoys a lifestyle buoyed by significant assets and financial backing courtesy of Cabba.

The narrative takes a more personal and poignant turn with the involvement of Cabba’s and Patti’s only son, Armando. From the tender age of 11, unbeknownst to Patti, Armando was reportedly ensnared in his father’s financial web. Legal and banking documents unveil that Traian Cabba orchestrated the setup of multiple bank accounts under Armando’s name, through which substantial sums from countries such as Russia, Cyprus, and Switzerland were funneled.

Central to enabling these clandestine transactions is Michael D’Ambra, a banker associated with TD Wealth Private Banking. D’Ambra is implicated in facilitating the flow of illicit funds by establishing banking arrangements under the guise of the Sheik Alumatari judgment, even employing the innocence of a minor as a veil for these operations. His testimony in the Sheik Alumatari court proceedings underscores a calculated effort to legitimize the banking framework necessary for maneuvering millions from Kuwait, further entrenching the depth and complexity of Cabba’s financial empire, supported by a cadre of enablers entrenched in both loyalty and complicity.

An Irresistible Offer – With a Sinister Twist

As the specter of escalating security fraud inquiries looms large, poised to unravel Cabba’s meticulously constructed illusion of stability, the consensus among those privy to the inner workings of his empire is one of diminishing options. An informant, choosing to remain shrouded in anonymity, conveyed a sobering perspective: “Should law enforcement agencies across various territories align their efforts, Cabba’s avenues for evasion may well find themselves constricted to a choke point.”

Patti, with a tone steeped in gravity, extends a stark caution to any individuals contemplating financial entanglements with Cabba’s ventures: “Pause for a moment, seek the counsel of seasoned experts, and dissect the available information with a critical eye, devoid of any unwarranted optimism.” She underscores the challenge in unearthing verifiable public records of Cabba’s historical transactions, suggesting that such scarcity is not coincidental but by design. Her advice to potential investors is unequivocal – any enticing projections or assertions put forth by Cabba warrant an exhaustive and meticulous vetting process.

Patti issues a dire warning for those weighing Cabba’s siren call: “Take a breath, consult professionals, nail down specifics without rose glasses.”

Credible public records on Cabba’s past dealings prove sparse for a good reason, she says. Bullish claims merit the deepest due diligence as precautions.

Because behind his polished façade and elite connections often unfold broken fortunes and black holes where money vanishes without recovery, so Patti concludes, “Tread carefully. When things seem too good to be true, they usually prove to be.”