PureKana Faces Collapse as $55,627 Debt Looms

Allegations of Insolvency

Scottsdale, Arizona, United States – PureKana, the once-soaring CBD company, finds itself on the precipice of financial ruin as it grapples with a staggering $55,627.10 unpaid debt.

This overdue invoice, owed to a supplier for online marketing services and left unsettled for several months, threatens to topple the very foundation of PureKana’s operations.

As the CBD industry continues to evolve at a breakneck pace, PureKana’s inability to meet its financial obligations raises alarming questions about its stability and future.

Despite its prominence in the wellness revolution, championing hemp-derived products, PureKana’s fiscal health appears to be crumbling beneath the weight of this substantial debt.

PureKana's $55,627 Debt Signals Deep Financial Distress

The $55,627.10 debt is not merely a figure on a spreadsheet but a glaring red flag signaling severe financial distress within PureKana.

This substantial sum, left unpaid for an entire year, raises alarming questions about the company’s financial management and ability to meet its obligations.

It is a clear indication that PureKana is grappling with a significant cash flow crisis.

The company’s failure to settle this obligation for such an extended period suggests a critical shortfall in its financial resources. This liquidity crunch could paralyze PureKana’s operations, forcing it to delay supplier payments, reduce investments in growth initiatives, and even struggle to meet payroll.

As word of these financial difficulties spreads, investors, employees, and partners’ trust and confidence will likely erode, further compounding PureKana’s woes.

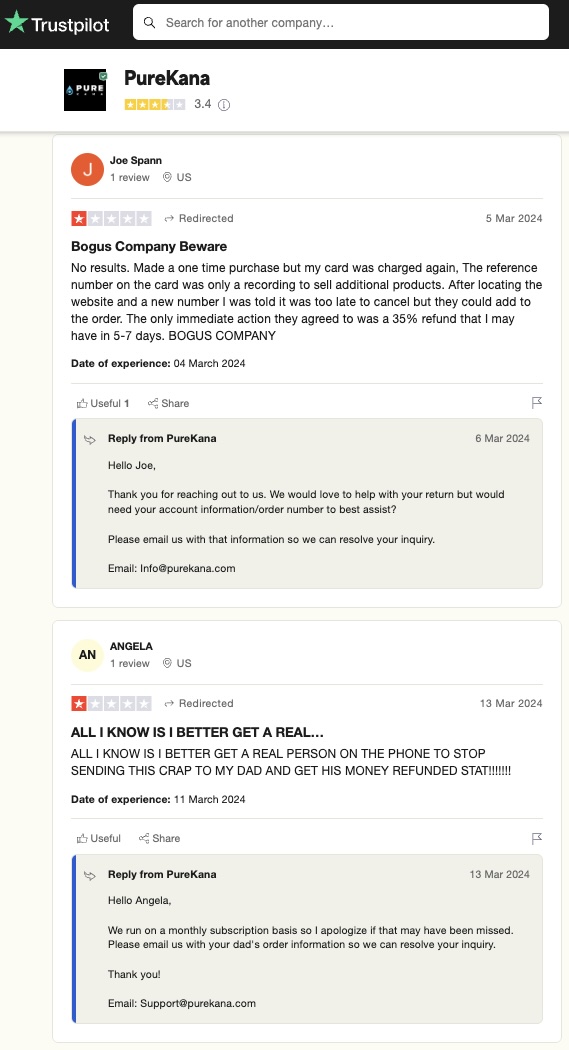

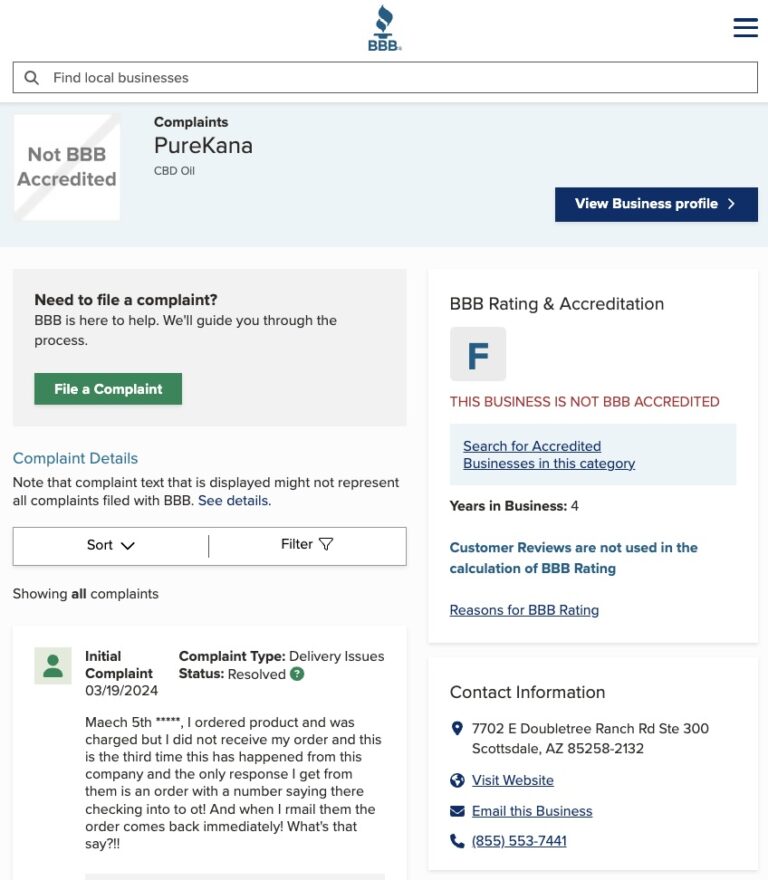

Despite mixed reviews on TrustPilot, PureKana has positioned itself as a leader in the wellness industry. However, this hard-earned reputation is now at risk of being overshadowed by the company’s financial troubles. In the worst-case scenario, the company may be wound up and the directors might face criminal culpability for trading whilst knowingly insolvent.

Industry Pressures Amplify PureKana's Woes

The accolade of being a trusted and transparent CBD brand now rings hollow as financial instability looms large over PureKana. The unpaid invoice is not an isolated incident but a symptom of a deeper malaise threatening the company’s once-promising future.

As PureKana struggles to manage its debt and maintain its operations, the qualities that once set it apart—its commitment to quality and transparency—are now in jeopardy, casting a shadow over its prospects in the highly competitive CBD market.

The CBD industry is a cutthroat arena, characterized by intense competition and stringent regulations that can strain even the most financially robust companies. As the market for CBD products surges, propelled by growing consumer demand, businesses must deftly navigate a labyrinth of challenges to maintain their footing.

Consequences of Collapse Would Be Far-Reaching

PureKana’s financial struggles stand in sharp contrast to the industry’s overall upward trajectory. While competitors forge ahead with expansion and innovation, PureKana finds itself mired in debt, at risk of being left behind. Whether the root causes lie in mismanagement, overextension, or the relentless pressure to maintain a competitive edge, the outcome is a company teetering on the brink of collapse, increasingly isolated in its fight for survival.

The potential consequences of PureKana’s financial collapse are far-reaching and dire. A company saddled with debt may struggle to invest in vital research and development, hindering its ability to innovate and stay ahead in a market that demands constant evolution. Promising projects that could have propelled PureKana to new heights may be abandoned, and the company’s capacity to attract and retain top talent could be severely compromised.

For PureKana’s employees, the looming threat of financial instability breeds uncertainty about job security and career prospects. Clients and suppliers, the lifeblood of PureKana’s supply chain and sales network, are left to wonder if the company can honor its commitments. The fallout from a potential collapse would extend far beyond PureKana’s walls, sending shockwaves through the industry and reshaping market dynamics.

As PureKana stands at this critical juncture, its $55,627.10 debt serves as a sobering reminder of the importance of financial discipline and resilience in the fast-paced CBD industry. The coming weeks will be pivotal as the company faces the urgent demands of its creditors and the heightened scrutiny of its stakeholders. The fate of PureKana hangs in the balance, and the industry watches with bated breath to see if this once-promising star can pull back from the brink of disaster.