Kardia Real Estate On the Brink Over $548,740.31 Debt?

Allegations of Insolvency

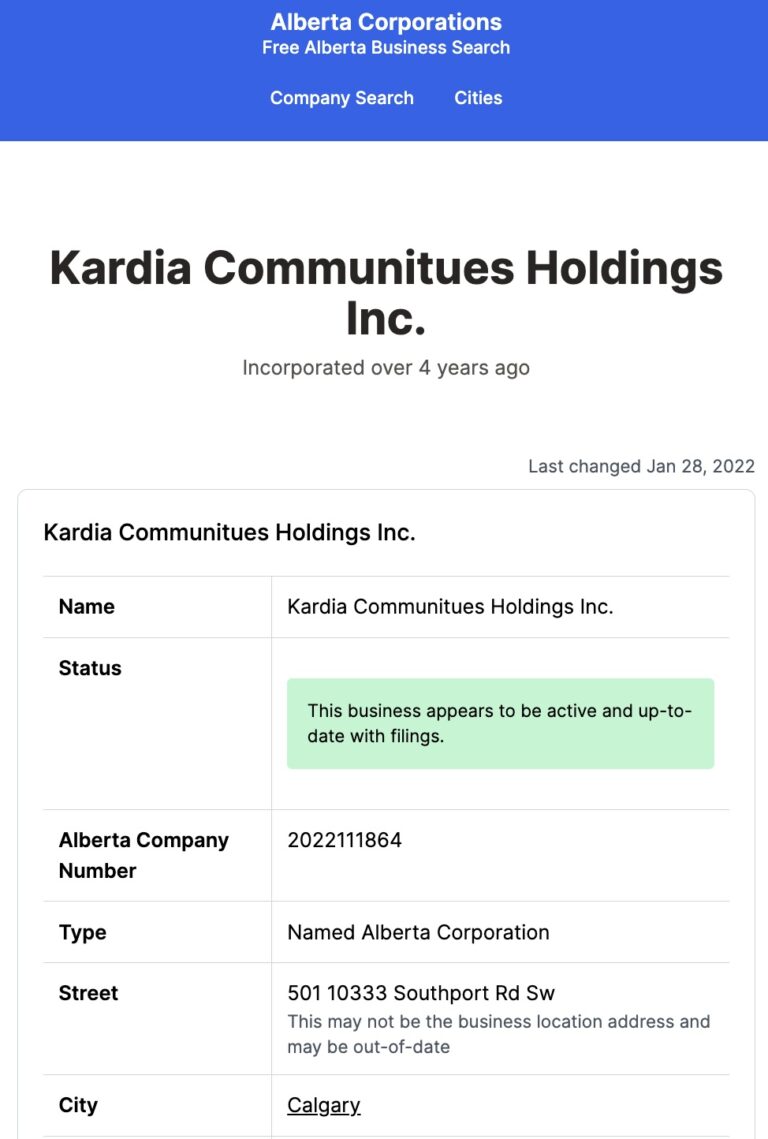

Calgary, Alberta – Kardia Real Estate, a prominent real estate and mortgage broking firm based in Calgary, Alberta, is navigating a severe financial crisis as it grapples with an outstanding debt of $548,740.

The company, known for its once thriving realestate business, now faces immediate cash flow concerns that threaten to undermine its ambitious projects and partnerships.

Founded with the vision of revolutionizing real estate through sustainable practices, ensuring food and water security, promoting green energy, and advocating for wellness, Kardia Communities Holdings Inc. has been at the forefront of creating socially accountable and environmentally sustainable communities.

However, the revelation of its substantial overdue debt has cast a shadow over the company’s financial stability and its ability to continue its mission of fostering economic growth through sustainable means.

The staggering debt of $548,740.31 represents a critical juncture for the firm, as it could lead to severe financial repercussions that may jeopardize its operations and future endeavors. This financial predicament not only reflects the company’s internal struggles but also highlights the broader challenges faced by businesses in maintaining liquidity within an increasingly competitive sector.

Immediate Cash Flow Concerns

As the industry progressively shifts towards green solutions, Kardia’s current financial situation may serve as a cautionary tale, underlining the risks associated with rapid expansion without adequate capital reserves. The company’s predicament raises concerns about its financial strategy and its capacity to adapt to the evolving landscape of sustainable development.

In an attempt to alleviate its financial strain, Kardia has actively sought agriculture project-related funding from the Canadian federal government. These lobbying efforts suggest that the company is exploring potential avenues to secure a financial lifeline. However, the effectiveness of these measures in providing timely relief remains uncertain, given the pressing nature of the outstanding debt.

The repercussions of Kardia’s financial struggle extend far beyond its balance sheet, as the livelihood of its employees, the trust of its clients, and the reliability of its suppliers hang in the balance. The company’s ability to deliver on its ongoing projects and fulfill its financial obligations to its workforce is now at risk. If left unresolved, the overdue debt could lead to a cascade of consequences, including halted initiatives, disrupted partnerships, and potential job losses.

The Financial Crux

As Kardia navigates this financial crisis, the management’s ability to steer the firm towards stability will serve as a testament to whether the company has a future. The company’s success or failure in addressing this debt will impact its future and set a precedent for financial management within the sustainability sector.

Industry experts and stakeholders are closely monitoring the situation, recognizing that Kardia’s outcome will serve as a benchmark for other companies operating in sustainable development.

The firm’s ability to overcome this financial hurdle will be a defining moment, demonstrating the importance of sound financial planning and the challenges of balancing ambitious sustainability goals with fiscal responsibility.

The Stakes Are High

As the story unfolds, the fate of Kardia Real Estate hangs in the balance, with the potential to either emerge stronger and more resilient or succumb to the weight of its financial obligations.

The coming weeks and months will be crucial in determining the company’s trajectory and the broader implications for the sustainable development industry as a whole.

Kardia’s vision for a sustainable future is now at a crossroads, with a hefty debt overshadowing its projects. The management’s ability to steer the firm out of this predicament will be telling of its resilience and capacity to uphold its commitments to partners and the community. The entire industry is taking note, as Kardia’s outcome will serve as a benchmark for financial management within the sustainability sector.