Great Basin Roofing Nearing the Precipice of Fiscal Collapse?

Allegations of Insolvency

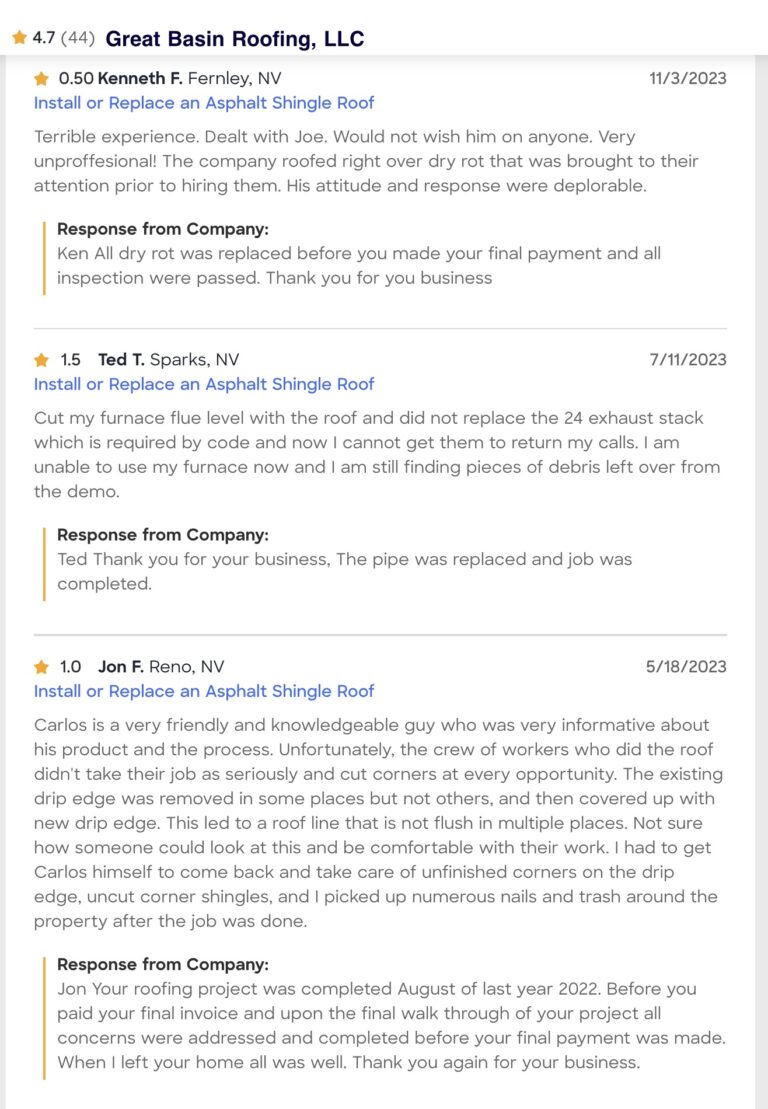

In the shadow of the Sierra Nevada, where the desert meets the sky, Great Basin Roofing, formerly known as Sacramento Steel Roofing, together with its founder Carlos Brandt, are now caught in a storm of financial turmoil.

Names previously synonymous with quality and resilience, the company and Mr Brandt have weathered the literal and metaphorical storms that have battered the roofing industry over the decades. Yet, today, it stands on precarious ground, its foundations shaken by a growing financial crisis that threatens to engulf its legacy.

Central to the company’s woes is the staggering debt of $147,035, a financial millstone that has hung around its neck for over 900 days. This overdue debt is not just a number; it is a testament to the cash flow crisis that has silently gnawed at the company’s vitals, undermining its operational efficiency and market position. The implications of this financial strain are far-reaching, affecting not only its immediate ability to procure materials and pay wages but also casting a long shadow over its future contracts and projects.

A Leak in the Finances

This debt stems largely from a court awarded judgment against founder Carlos Brandt, previously residing in California and trading as Sacramento Steel Roofing. The judgment was a consequence of Mr. Brandt’s decision to ignore his warranty obligations concerning a roof repair, despite being given the opportunity to rectify the issue before legal action was pursued. After the judgment was awarded against him, Mr Brandt relocated his business in California to Nevada and rebranding as “Great Basin Roofing LLC” which further complicates the narrative of a businessman attempting to escape his past, only to find that financial and ethical shortcuts offer no real escape from accountability.

This financial distress does not exist in a vacuum. It mirrors a broader narrative of economic challenges that have beset the construction and roofing industry at large. Rising material costs, labor shortages, and the unpredictable swings of the housing market have all contributed to a perfect storm, within which Great Basin Roofing’s struggles are amplified. However, what sets the company apart is its significant overdue debt, which starkly contrasts with the otherwise buoyant market where many competitors have navigated these challenges with greater agility.

The roofing industry, characterized by its cyclical demand and sensitivity to economic shifts, demands resilience and adaptability from its players. In this context, Great Basin Roofing’s predicament is a cautionary tale of what happens when a company, despite its historic strengths and market reputation, fails to pivot and adapt to the changing economic winds. The firm’s difficulties underscore a unique position within the industry, serving as a bellwether for the consequences of financial mismanagement and market myopia.

Financial Distress Leading Great Basin Roofing to Collapse?

The repercussions of Great Basin Roofing’s financial instability extend far beyond the immediate concerns of unpaid debts and halted projects.

At stake are the trust of its clients, and the confidence of its suppliers. Will existing projects complete? Only time will tell.

The potential collapse of Great Basin Roofing not only threatens to erase a stalwart of the Nevada roofing industry but also to leave a void that would ripple across the local economy and the broader ecosystem of related businesses.

Moreover, the company’s financial woes cast a long shadow over the industry’s innovative capacity.

Drowning in Debt

Financial health is critical for sustaining investment in new technologies and practices that drive efficiency, sustainability, and resilience in roofing solutions. As such, Great Basin Roofing’s predicament serves as a stark reminder of the critical nature of financial stewardship, underscoring the importance of adaptability and resilience in navigating the unpredictable terrain of the construction sector.

The story of Great Basin Roofing, caught in the throes of financial distress, is more than a narrative of one company’s struggle. It is a reflection on the broader themes of economic resilience, market adaptability, and the imperatives of financial management in the face of industry-wide challenges. As employees, clients, and suppliers watch anxiously from the sidelines, the fate of Great Basin Roofing hangs in the balance, a poignant emblem of the precariousness that defines the modern business landscape. The company’s journey from prosperity to peril serves as a cautionary tale, reminding us of the fragility of success in the absence of vigilance, adaptability, and prudent financial planning.